中国的合作伙伴 : 投资中国,在中国做生意,在中国咨询,使中小型企业国际化

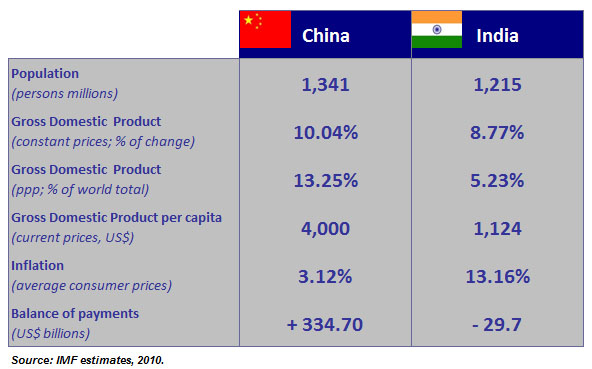

Comparing opportunities: China and India

China and India are the two giants of Asian developing economies.

China and India are the two giants of Asian developing economies. According to International Monetary Fund (IMF) estimates, Gross Domestic Product (GDP) is expected with + 10.04% of change in 2010 (constant prices; 8.74% in 2009) for China and 8.77% for India (5.67% in 2009), respectively corresponding to a per capita GDP (current prices) of about 4,000 US$ for China in 2010 (more than two times of 2005 one) and 1,124 US$ for India. GDP based on Purchasing Power Parity (PPP), as share of world total in 2010, is 13.25% for China and 5.23% for India. Inflation (average consumer prices) is increasing in both countries, although it is significantly higher in India (13.16% in 2010) than in China (3.12% in 2010, after a negative value in 2009). However, inflation is estimated to decrease in both countries. Population is 1,215 persons millions in India and 1,341 in China (2010). About balance of payments, current account balance is positive for China (334.7 US$ billions in 2010; 6.24% GDP), while it’s negative for India (-29.7 US$ billions in 2010). Bilateral trade between China and India has grown significantly since 2005, with a contraction just in 2009, due to the global economic and financial crisis. The figures just given show that the two countries are markets with enormous potential, highly attractive for foreign investors. China’s main focus for next years is on improving the inland regions, while in the past it mostly focused on its coastline. This regions could become an extraordinary source of domestic demand for China. Besides, China is deeply investing on technologies and engineering, to further develop infrastructure and services. On the other side, India can count on a sufficiently stable banking system, it has has relatively little foreign debt, its middle-class is growing up very quickly and has many raw materials. India has been interested by a process of development and reform that has given a major boost politically. The Government is making huge amounts of financing available for foreign investment and participation to assist with the redevelopment of the country in terms of infrastructure. Hereinafter there will be compared to the main form to establish in the two countries for the foreign investors. China is therefore a very high potential, both with regard to the internal market and exports; India, which also has a high potential, does not yet appear on the Chinese levels. The first way for foreign investors to establish in these countries could be Representative Office (RO) in China and Liaison Office (LO) in India. Both offices could be a suitable vehicle to use for foreigners not still certain on Chinese and Indian markets. RO and LO are very similar: they are not independent legal entities, they don’t require any capital investment and their scope is limited just to some activities (e.g. information collection, promotion, marketing,…). They can not directly undertake any commercial activities. For RO in China, taxes on expense turnover is at 15%, it’s subject to income tax and vat chargeable. LO in India is not vat chargeable and becomes subject to taxation just when it becomes a permanent establishment. This is due to Indian intention of promoting its trade and special economic zones with tax incentives, while China prefers other ways for foreign establishment. To fulfilling foreign investors intentions of importing and exporting goods, buying and selling goods, trading or offering consulting services, China has the form of Foreign Invested Commercial Enterprise (FICE), India has Branch Office (BO). Chinese FICE is an independent and limited liability legal entity , with a minimum capital investment of US$ 4,420. Indian BO is not a company and it doesn’t require a minimum capital investment. About industry restrictions, FICE can only sell what is purchase, BO is limited on retail. FICE has an income tax of 25%, while for BO it is of 41.86%. VAT is 17% for FICE and 12.5% for BO. Both FICE and BO permit to remit profit back to overseas. Finally, we can compare Chinese Wholly Foreign Enterprise (WFOE) with Indian Private Limited Company (PLC). Both WFOE and PLC are limited liability companies, with minimum capital investment of US$ 2,500 for PLC and industry specific for WFOE. Income tax is 25% for WFOE and 33.99% for PLC; VAT is 17% for WFOE and 12.5% for PLC. WFOE is subjected to a profit repatriation tax of 10%. Up o date, the legislation about foreign investment is more developed in China and this could represent a point in favour of the decision to invest in the Country. Anyway, India could be attractive for other reasons.

关于我们

由于我们拥有专业人士和广泛的中国网,也叫作 " 关系 ",我们咨询公司能为打算投资中国的客户提供全方位的支持。而这(尤其是中小型企业)会使公司在中国做生意时的危险和失望减到最少。