Ihr Partner zum Investieren in China : China investieren, Business in China, Beratung über China, in China investieren, Internationalisierung KMB in China

A new vehicle to invest in China: the Partnership (FIP)

The Administrative Measures for establishing partnership enterprises in China, promulgated on November 25, 2009 and on force from March 1, 2010, are the first legal framework for foreign invested partnership (FIP) in the country.

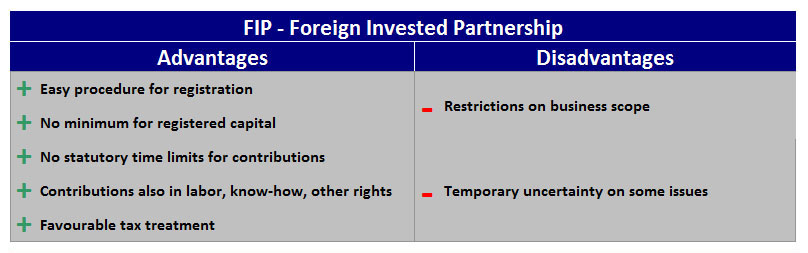

The Administrative Measures for establishing partnership enterprises in China, promulgated on November 25, 2009 and on force from March 1, 2010, are the first legal framework for foreign invested partnership (FIP) in the country. China adopted the Measures aiming to attract “advanced technologies and management expertise (…) to boost the development of the modern service society” (article 3 of Measures). Regulation about FIP refers to: areas of applicability of FIP, set-up procedures, procedures for amendments, changes and closing. The following questions/answers will be useful to clarify FIP’s peculiarities.

How is a FIP?

According to Article 2 of Measures, FIP can be made of two or more

companies or foreign individuals (wholly foreign FIP, WFO-FIP) or one

or more foreign companies or individuals in partnership with one or

more companies or individuals in China (sino-foreign FIP).

Who is

allowed /not allowed to be partner of a FIP?

Publicly-listed enterprises, State-Owned Enterprises,

Government-sponsored public welfare institutions, other social

institutions involved in public welfare, both foreign and Chinese can

not be partner of a FIP.

How to

register a FIP?

According to article 5, a FIP can be registered directly with

provincial or local branches of the State Administration of Industry

and Commerce (SAIC), without any prior approval by PRC Ministry of

Commerce (MOFCOM). The registration has only to be notified to MOFCOM.

MOFCOM prior approval in compulsory just when FIP’s business scope is

defined as restricted according to Foreign Investment Industrial

Guidance Catalogue.

Which is the

minimum registered capital?

There isn’t a minimum for FIP’s registered capital.

About capital

contributions: are they allowed just in cash?

Capital contributions are allowed in: cash (foreign currencies or

legally obtained RMB) or other assets (including labor, know-how, other

rights). Contributions to FIPs are not subject to statutory time

limits.

What about

bearing liability by partners?

FIP’s partners can be limited partners or general partners. Limited

partners bear liability according to capital contributions; general

partners bear joint and several liability of partnership debt. General

partners conduct business on behalf of FIP, while limited partners can

not do this.

Shares’ transfer is quite easy and doesn’t need approval by other

parties.

Has a FIP a

favourable tax treatment?

Taxes are not mentioned in the Document. FIP is subject to Partnership

Enterprise Law: it is exempted from corporate income tax.

Enterprise partners themselves are subject to 25% corporate income tax.

Individual partners are subjected to 5-35% individual income tax.

For limited individual partners, there is a 20% tax rate on interests

and dividends.

FIP represents a way easier and more flexible than others to access

Chinese market.

Dienstleistungen

Unser breiter Network ermöglicht ein ausführliches Angebot an Beratungsdienstleistungen zur Investition in China. Wir helfen bei der Internationalization vom SME in China:

Die Gesellschaft

Unsere Beratungsgesellschaft unterstützt völlig in allen Schritten den Kunden, der in China investieren will. Dank unsereR professionellen Mitarbeitern und des breiten strukturierten chinesischen Network – “Guanxi” genannt – ist das alles möglich. Das erlaubt den Betrieben ( speziell das SME ), das Risiko und die Probleme zu unterbreiten, die bei einer Investition in China möglich sind.