Vôtre partenaire pour la Chine : China investieren, Business in China, Beratung über China, in China investieren, Internationalisierung KMB in China

Sino-Chinese Joint Ventures

Before deciding to invest in China, the foreign investor must first make a fundamental decision about what form the investment should take: mainly, the investor can do it alone and form a 100% foreign-owned entity (wholly foreign owned enterprise, “WFOE”), or work together with an existing Chinese partner and operate through some form of joint venture.

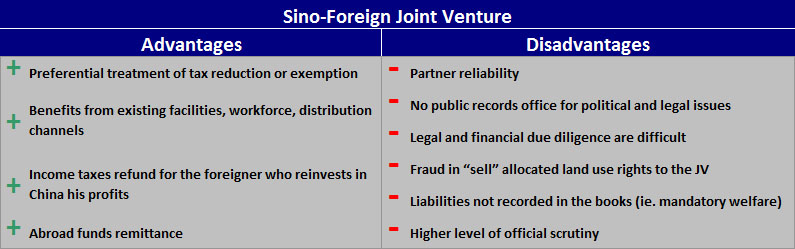

The joint venture was among the leaders of the reform of international trade law in China started in the late Seventies (“open door policy”); the discipline of the joint venture is now contained in the Law of the People's Republic of China on Chinese-Foreign Joint Ventures. (http://www.china.org.cn/english/features/investment/36752.htm) A JV should represent a good solution for investor who wants to benefit from existing facilities, workforce and exiting sales’ distribution channels, or a forced choice when Chinese Government restrictions require a local partner; a joint venture may enjoy preferential treatment of tax reduction or exemption in accordance with state tax laws and administrative regulations. A foreign partner in a joint venture that reinvests in China its share of the net profit may apply for refund of a part of the income taxes already paid. The net profit that the foreign side in a joint venture receives after fulfilling its obligations under the laws and various agreements and contracts, the funds it receives at the time of the joint venture's scheduled expiration or early termination, and any other funds, may be remitted abroad in accordance with the foreign exchange regulations and in the currency specified in the joint venture contract. However, the benefits of the JV may be overestimated with respect to the issues that this form may have: the particular risks involved with this type of arrangement require very careful planning. In additional to what has been yet said in the deepening “Vehicles to invest in China”, this article will emphasize a few points to consider carefully before deciding to start a JV in China. From the legal point of view, a Chinese joint venture shall take the form of a limited liability company under PRC company law. The proportion of the investment contributed by the foreign joint venture(s) should generally not be less than 25 percent of the registered capital of a joint venture. The joint venture agreement, contract and articles of association signed by the parties to the venture should be submitted to the competent foreign economic and trade department of the state for examination and approval; the examining and approving organ shall, within three months, decide whether to approve or disapprove them. After approval, the joint venture should register with the competent administration department for industry and commerce, obtain a license to do business and start operations. Each party to a joint venture may make its investment in cash, in kind or in industrial property rights, etc. The investment of a Chinese partner in a joint venture may include the right to the use of a site provided for the joint venture during the period of its operation. In this case, the foreign investor must be careful because there are two types of land use rights in China, granted and allocated. Granted rights mean you own the land, while allocated mean you have the right to use it. Chinese businessmen will often include the land use rights valuation as their contribution to the JV equity, but the investor needs to ensure that he really owns these rights, that the pricing is correct and that the rights operational term is intact. In fact, very common fraud in China is to “sell” allocated land use rights to the JV, but inflate their equity position by using the costs of granted rights (www.dezshira.com).These issues can be cross-checked independently at the local land bureau (all Chinese towns and cities have one). If the right to the use of the site does not constitute a part of a Chinese partner's investment, the joint venture shall pay the Chinese government a fee for its use. A big issue of this form could be partners’ reliability, so first of all the foreign investor should be prudent and aim to know exactly who his partners are. This could be difficult to find out in China, as there is no public records office for political and legal issues. Legal and financial due diligence could facilitate the verification, even if they are particularly difficult in China, because there are no publicly available records systems that permit viewing of reported items/accounts. For example, many companies in China do not properly pay mandatory welfare, and this liability may be left off the books, becoming a big issue for JV. Besides, in China the business, as partially foreign owned, is “upgraded” in status by the Chinese authorities in terms of attracting a higher level of official scrutiny, so it is important that all the records are in compliance with the law (www.dezshira.com). According to these issues, investors tend to prefer WFOE to avoid difficulties and potential conflicts related to the presence of a local partner as in JV (in 2008, 29,543 foreign investments projects as WFOE and 8,290 as JV, according to National Bureau of Statistics of China).

Services

Notre réseau étendu nous permet de donner un ensemble complet de services de conseil pour investir en Chine. Nous fournissons aide pour l'internationalisation de la PME en Chine en ce qui concerne :

La société

Notre compagnie de consultation soutient chaque phase d'affaires pour le client qui veulent investir en Chine, grâce à nos personnes professionnelles et notre réseau chinois étendu, également appelée « Guanxi ». Il permet à la compagnie (PME en particulier) de réduire au minimum les risques et les déceptions en faire des affaires en Chine.